Thoughts on the Market Ahead of the August USDA Report

Aug 01, 2025

Zack Gardner

Grain Marketing & Origination Specialist

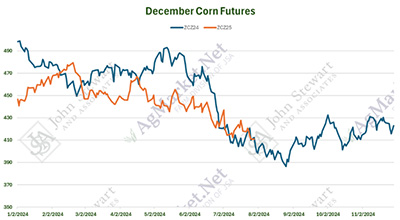

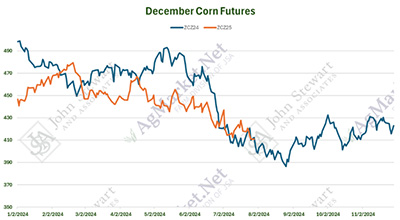

If I had to give a prediction or my best guess as to what the market will do, I think we might see a similar marketing year to last year.

Click to view.

I’m hoping we might be finding a bottom here soon ahead of the August USDA report on the 12th. It feels to me as if the market is pricing in a 185 bu/acre corn crop. Currently, the USDA is at 181 bu/acre. I do think the USDA needs to raise their corn yield estimate as crop conditions are good for this time of the year. However, between too much rain in our area and some potential pollination issues, I would make the case for raising it to only 182.5 or 183 bu/acre. If the market is pricing in a 185 bu/acre corn crop and the USDA only gives us 183 bu/acre, is that friendly to markets from where we are priced today?

What might cause a rally in the future? Today, we are fully loaded on moisture, so it will be difficult to convince the funds of a drought scare in the next year. Last year’s rally came from the drastic 250 million bushel increase in corn exports on the January report, as well as the continual increase on almost every other month’s report for the year. The USDA missed our export estimate by 475 million bushel this past year! This year, my guess is on an acreage switch causing a rally in the February/March time frame. We are currently seeing one of the highest nitrogen-to-corn price ratios that we have ever seen. If that price ratio doesn’t change, I could easily see our heavy corn acreage number this year turn into a big soybean acreage number for next year.

As far as marketing strategies, that means proactively looking at next year’s soybean prices at the same time as we look at this fall and spring’s ammonia prices. That also means evaluating how much we think the corn market can rally and comparing that to the cost of storage/interest (approximately $0.10/month for corn) and the value of a minimum price contract. If you’d like to go over contracting options or a game plan for marketing, give one of our grain originators a shout!

Grain Marketing & Origination Specialist

If I had to give a prediction or my best guess as to what the market will do, I think we might see a similar marketing year to last year.

Click to view.

I’m hoping we might be finding a bottom here soon ahead of the August USDA report on the 12th. It feels to me as if the market is pricing in a 185 bu/acre corn crop. Currently, the USDA is at 181 bu/acre. I do think the USDA needs to raise their corn yield estimate as crop conditions are good for this time of the year. However, between too much rain in our area and some potential pollination issues, I would make the case for raising it to only 182.5 or 183 bu/acre. If the market is pricing in a 185 bu/acre corn crop and the USDA only gives us 183 bu/acre, is that friendly to markets from where we are priced today?

What might cause a rally in the future? Today, we are fully loaded on moisture, so it will be difficult to convince the funds of a drought scare in the next year. Last year’s rally came from the drastic 250 million bushel increase in corn exports on the January report, as well as the continual increase on almost every other month’s report for the year. The USDA missed our export estimate by 475 million bushel this past year! This year, my guess is on an acreage switch causing a rally in the February/March time frame. We are currently seeing one of the highest nitrogen-to-corn price ratios that we have ever seen. If that price ratio doesn’t change, I could easily see our heavy corn acreage number this year turn into a big soybean acreage number for next year.

As far as marketing strategies, that means proactively looking at next year’s soybean prices at the same time as we look at this fall and spring’s ammonia prices. That also means evaluating how much we think the corn market can rally and comparing that to the cost of storage/interest (approximately $0.10/month for corn) and the value of a minimum price contract. If you’d like to go over contracting options or a game plan for marketing, give one of our grain originators a shout!